Roblox Corp is a global cloud-based 3D gaming/experiences company that was founded by CEO David Baszucki and Erik Cassel.

The Roblox experiences platform consists of:

Roblox Client - The Roblox Client allows users to access a diverse range of free-to-play experiences and games, catering to various genres and age groups. Available on iOS, Android, PC, Mac, Xbox, and VR, users can purchase Robux, Roblox's virtual currency, through one-time transactions or a monthly subscription to Roblox Premium. This subscription offers discounted Robux, exclusive experiences, and savings on avatar features or in-game items. Most monetary transactions occur within the Roblox Client, where users buy Robux to customize their avatars in the 3D virtual environment. As of December 31, 2022, 32% of Robux sales were made through the Apple App Store and 18% through the Google Play Store.

Roblox Studio - Roblox Studio equips developers and creators with tools, resources, and analytics to design games and experiences accessible via the Roblox Client. Many start as users before becoming creators, building most platform content and co-owning experiences with Roblox Corp.

Creators can earn Robux by selling access to experiences, in-game items, avatar features, and content between developers in Roblox Studio. They also earn revenue based on time spent by premium subscribers in their experiences. Creators can convert earned Robux into real-world currency using the Developer Exchange Programme.

Roblox Cloud - Roblox Cloud powers the Roblox Client, allowing users worldwide to engage in experiences together in real-time. Primarily hosted on Roblox-owned data centres across North America, Asia, and Europe, it also utilizes Amazon Web Services (AWS).

Leveraging over 100,000 servers, Roblox Cloud delivers a seamless experience, minimizing latency and supporting high-fidelity assets like graphics and audiovisual elements. Roblox operates its own network, bypassing the public internet and directly connecting with global internet providers to optimize performance and immersion for users.

How Roblox Corp makes its Revenue

Bookings represent Roblox Corp's sales activity in a given period, generated through virtual item sales and other purchases on the platform. Initially recognized as deferred revenue, they become revenue based on the estimated duration of purchased virtual assets and the average life of a paying user (28 months in 2022, 23 months in 2021). Bookings also include advertising and licensing revenues.

Roblox retains a portion of each transaction, with developers and creators receiving 30% of Robux spent by users, while sellers or distributors receive 40%, and the marketplace gets the remaining 30%. When developers and creators sell items through the Roblox marketplace, Roblox receives 70% of the Robux, and creators get the remaining 30%. Creators can convert Robux into real-world currency.

As of December 2022, the average Robux price was $0.01, with creators redeeming at an exchange rate of 1 Robux to $0.0035. The $0.0065 spread contributes to Roblox's revenue. The Developer Exchange Fees as a percentage of revenue decreased from 35.6% in 2020 to 28% in 2021 and 2022, indicating that Roblox retains a significant portion of real-world currency transactions.

Corporate Governance Issues

The dual-class stock structure of Roblox Corp, consisting of Class A and Class B stock, poses a significant challenge to corporate governance. Class A shares, traded on the NYSE, have a one-share-one-vote structure, while privately held Class B shares, owned by three individuals including CEO David Baszucki, carry 20 votes per share.

As of December 31, 2022, there were 553,337 Class A shares with equal votes, and 51,337 Class B shares with 1,026,740 votes—nearly double the Class A votes. When CEO David Baszucki sells Class B shares, they convert to Class A shares on a one-to-one basis, reducing voting rights from 20 votes to 1 per share. This structure ensures absolute control for Class B shareholders, questioning the fairness to common shareholders.

Despite the CFO's assurances during the September 2022 Investor Day Conference about considering shareholder dilution, the corporate structure contradicts these claims. The fine line between "skin in the game" and absolute power should be a warning for shareholders. Shareholders Beware!

Flywheel Effect of Roblox Corp

With the beginning of the pandemic, the Roblox platform saw a steep increase in users as people were forced to remain at home due to lockdowns enforced across the globe. Young people increasingly began to engage with experiences on the Roblox platform with friends as a substitute for real-world interactions. Surprisingly, one might imagine people would stop using Roblox once the pandemic ended, but this was not the case; in fact, the number of users has grown since then.

As the user base increased on the platform, people invited their friends to join, and the platform continued to grow through word of mouth. As more users engaged with the platform, it became a lucrative proposition for developers to create unique experiences that could be monetized efficiently using developer tools in Roblox Studio. Better and more engaging experiences, in turn, attracted more users to the platform, which further incentivized developers and creators. This created a reflexive loop that drives the Roblox platform's growth.

Valuation Numbers & Narratives

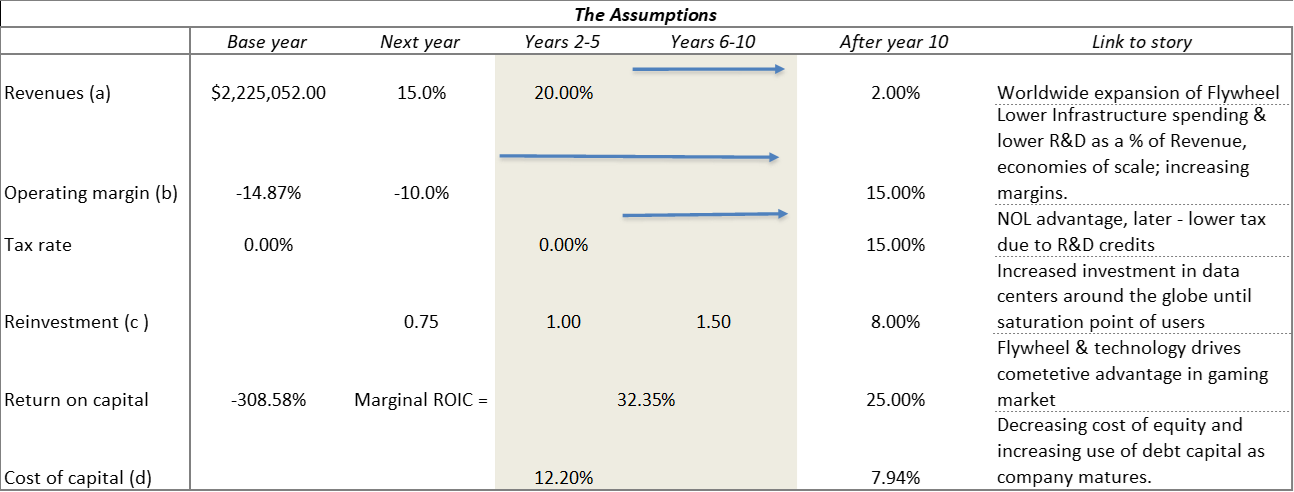

Assumptions of Inputs

Revenues :

The Roblox platform has spread across the globe through word of mouth, using mediums such as YouTube, TikTok, Discord servers, and Reddit.

The percentage increase in users in the Asia-Pacific region (including Australia and New Zealand) and the rest of the world is higher than that of Europe and North America. We expect this trend to continue in the future, with the North American user base tapering off. While users in the Asia-Pacific and the rest of the world appear to be increasing, the user base in developing countries does not spend as much on games and entertainment as their North American and European counterparts. However, the potential user base in these regions is significantly larger than that of North America and Europe.

Although the majority of Daily Active Users (DAUs) are from outside the USA, most of the bookings and revenue come from the USA, making American users more valuable compared to their counterparts across the globe. This can be observed in the fact that while DAUs have increased, the Average Bookings per User (ABPDAU) decreased in 2022 compared to 2021.

For many years, the majority of Roblox users were under the age of 18. However, with improvements in graphics and other technologies on the platform, older users have started to engage with the platform in higher numbers. This older age group has greater financial resources that they can spend to enhance their experiences on the platform.

The Roblox platform is also seeking to enhance virtual experiences by including concerts, education, and brand advertising partnerships. We expect these avenues to contribute to revenue growth as high-fidelity (immersive-realistic) experiences become more commonplace. Imagine experiences on the level of those in the film "Ready Player One."

Operating Margin :

Cost of Revenue for Roblox mainly consists of payment processing fees, with 30% of transactions paid to the Apple App Store and Google Play Store.

Roblox aims to expand Robux purchasing options to retailers like Amazon to reduce costs. The 30% charge may change due to antitrust investigations and the Epic Games v. Apple lawsuit. As gaming evolves into AR, VR, and XR, the 30% charge could become more entrenched since AR/VR hardware companies rely on it for profits and reinvestment. In contrast, mobile devices are profitable, reducing the need for a 30% fee in app stores.

Roblox could end Robux conversion on app stores and offer discounted Robux desktop purchases, like Netflix and Spotify. While this may initially reduce revenues and user adoption, it could increase operating margins by avoiding the 30% fee. However, this approach is currently unlikely, as it risks harming long-term growth and potential bans from Apple and Google App Stores, as seen in the Epic Games Fortnite saga.

Developer Exchange Fees - Developer Exchange Fees are likely to remain stable because developers create experiences on the platform, and with the emergence of AR/VR/XR platforms, competition to attract diverse developers and creators is expected to increase. Any decrease in developer payouts could lead to developers leaving for other platforms, such as Meta or Fortnite.

Infrastructure, Trust & Safety - costs encompass managing data centres and maintaining the technical infrastructure, such as cloud services, to ensure seamless and low-latency experiences for users across the globe. As revenues grow and the user base stabilizes, economies of scale are likely to emerge, leading to a reduction in costs relative to revenue. This presents the most probable opportunity for long-term margin expansion.

Research & Development - R&D expenditure currently amounts to 39% of revenue. High R&D spending has been necessary to catch up with cutting-edge technologies that deliver immersive experiences to users. A noticeable difference in graphics and real-world physics can be seen before and after 2022. Roblox has developed machine translation, advanced pattern recognition, and generative AI, among other technologies, to enable developers to create better experiences more quickly and efficiently. As Roblox becomes a forerunner in gaming technologies, the need to catch up with existing tech will decline, and we can expect R&D expenditure as a percentage of revenues to decrease substantially.

Taxes :

Net Operating Losses (NOLs) and R&D credits accumulated over the past years will shield operating income from taxation and are likely to remain close to zero over the next 5-8 years. Over the longer term, taxes are expected to approach but remain below the marginal tax rate due to continued R&D credits and the debt tax shield resulting from increased use of debt in the capital structure.

Reinvestment :

As the number of users increases and immersive technology becomes more widely adopted, additional investments will be required in data centres worldwide to host experiences on the cloud, as well as property to house those centres and offices for global personnel. As the growth of users begins to taper off, we anticipate a decrease in investments needed for building and operating new data centres.

Return on Capital :

Although mature companies often struggle to achieve returns above their cost of capital, we believe that Roblox's flywheel effect provides a significant competitive advantage. The value added by technology R&D ensures that returns on capital over the long-term horizon will be far greater than the cost of capital.

Cost of Capital :

As the company matures, the use of debt in the capital structure will increase to take advantage of the debt tax shield. Simultaneously, the required return on equity will decrease, which will contribute to a reduction in the cost of capital over time.

Conclusion of Roblox Corp Analysis

The Roblox platform is set to become a significant contender in the AR/VR/XR space, alongside industry giants such as Meta, Google and, Apple. Its applications are expanding beyond gaming, incorporating real-world events like concerts and educational experiences. As a recent user of the platform on both desktop and mobile, I find it to be an immersive experience that fosters connections with people worldwide, whether it's playing Texas Hold'em, Brookhaven, or Tower of Hell – it's incredibly enjoyable!

However, there's a gap between the value of Roblox Corp as a business and its stock price. As an entertainment platform, Roblox must compete with other forms of entertainment, such as television, movies, and social media. Its main advantage, the flywheel effect, is due to a diverse array of developers creating various games, but this comes at the cost of higher developer expenses. Although the platform offers numerous options, the average paying user's lifespan is only 28 months, and retaining users for over 36 months remains a challenge. However, investment in improving high-fidelity assets seems to be paying off, as evidenced by the increase in DAUs to 67.3 million in February from 56 million as of December 2022, along with a 20% YoY increase in revenues and bookings.

Throughout its operating history, Roblox Corp has been losing money and generating negative free cash flow. As a result, the company has had to compensate a significant portion of employee remuneration with stock options, which may continue in the near future. This practice has diluted shareholder value, especially considering the average strike price of exercisable options is $2.84 compared to the current share price of $46. Additionally, Class A common stockholders face an uphill battle when attempting to enact change, as they are likely to be outvoted by the three holders of Class B common stock. Over time, shareholders will realize that there is limited room for margin improvement despite revenue growth, due to the near-fixed nature of payment processing fees and Developer Exchange Fees as a percentage of revenue, which account for 60% of total revenue. With only 40% left, Roblox will need to allocate funds to R&D and Infrastructure Trust & Safety to remain competitive in the entertainment market, while also covering SG&A expenses. We do believe that Roblox Corp stock is worth $5.06 ± 10%, and that the market will eventually come to recognize it as such.

As the AI and technology used in the Roblox platform continue to improve significantly, the possibilities of improved real-life immersive experiences become increasingly exciting for users. I eagerly anticipate the moment when I can say with utmost sincerity…