ViacomCBS is a Global Media & Entertainment company in TV Entertainment, Cable TV, and Filmed Entertainment segments. ViacomCBS’ portfolio of brands includes CBS, showtime, Paramount Pictures, Nickelodeon, MTV, Comedy Central, BET, Smithsonian Channel, Paramount+ and Pluto TV to name a few.

The Entertainment segment, which consists of the CBS Television network accounts for approximately 40% of consolidated revenues.

The Cable Network segment is a heterogeneous portfolio of streaming platforms and cable services such as Pluto TV (AVOD/FAST-Free advertising-supported streaming television), Showtime (Premium subscription streaming), Nickelodeon, MTV (Basic cable) and accounts for approximately 50% of consolidated revenue.

The Filmed Entertainment segment through Paramount Pictures and Miramax, accounts for approximately 10% of revenues.

Over the past decade, there has been a seismic shift towards the consumption of streaming services. Being cognizant of this seismic shift in consumption, ViacomCBS has and is undergoing changes in strategy to become a global streaming organization. With this change, ViacomCBS will concentrate its operations on the studios, networks, and streaming businesses. ViacomCBS Is well placed to make the change as it has the infrastructure and resources due to its existing operations and is well-versed in Producing-Distributing content and providing advertising solutions for its content.

ViacomCBS will seek to add value by:

1) Leveraging its existing intellectual property and vast content library.

2) Maximise value from the biggest lines of revenue - Advertising, Affiliate, and Content Licensing.

3) Increased penetration of streaming services - Free, Pay, and Premium content.

The pandemic has not adversely affected the revenues apart from the advertising revenues of ViacomCBS but may have helped its push towards streaming services. Due to the pandemic and the following lockdown, the production of content was drastically impacted and has had an effect in delaying new content (example: Halo tv show produced by Amblin Entertainment-Steven Spielberg) coming to market. As vaccination rates increase in the developed world, I expect production to resume, which may lead to ViacomCBS incurring incremental costs relating to health and safety protocols that would be required to be on the side of caution.

Revenue sources are classified by the categories based on the nature of revenues:

1) Advertising

2) Affiliate

3) Streaming

4) Theatrical

5) Licensing and other.

1) Advertising - As the world adapts to the new normal, and with production back online, I expect advertising revenue to return to and surpass pre-pandemic levels.

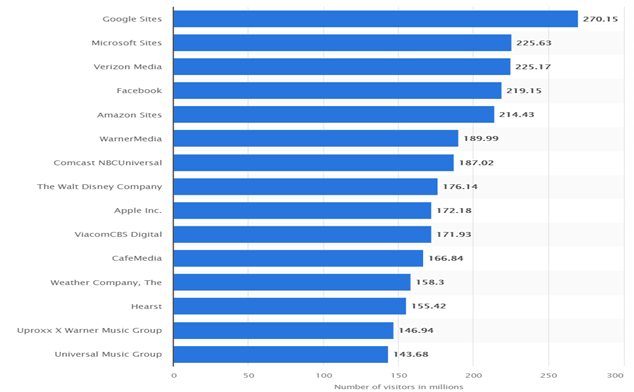

With an increase in viewers and streaming subscribers - EYEQ - A digital advertisement buying platform that enables advertisers and advertising agencies to better use data that enables precision and accurate target advertising to viewers of required relevant categories and demographics. This platform would increase the efficiencies of advertisers and would command a higher premium, and as streaming subscribers on Pluto TV and Paramount+ ( Live Sports - NFL, Serie A, etc.) increase, there would be an even higher premium paid by advertisers to get access to preferred demographics.

2) Affiliate: comprised of fees received from Multi-Channel Video Programming Distributors (MVPDs) and third-party live television streaming services (including YoutubeTV) and subscription fees. In Q3, ViacomCBS expanded and renewed multiyear distribution deals with both Charter Communications and Cox Communications, and most recently with Sky (Comcast) in Europe.

Declines in affiliate viewership are lower than the increase in streaming viewership which will lead to what I expect to be lower growth rates in affiliate revenues in the future.

3) Streaming: As ViacomCBS moves towards becoming a global streaming organization, it has expanded its offering with Pluto TV, and Paramount+: which includes content from CBS, Nickelodeon, Comedy Central, Paramount Network, MTV, VH1, Showtime, and BET.

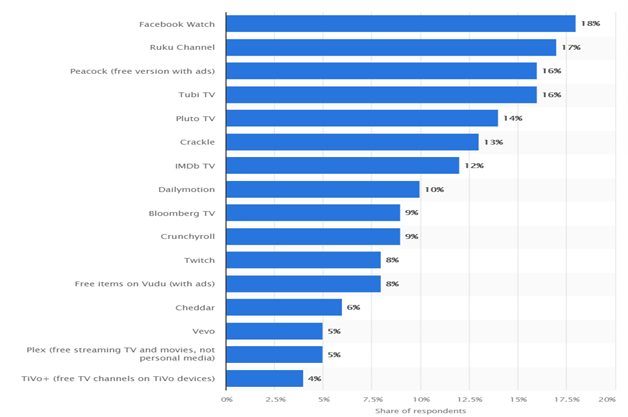

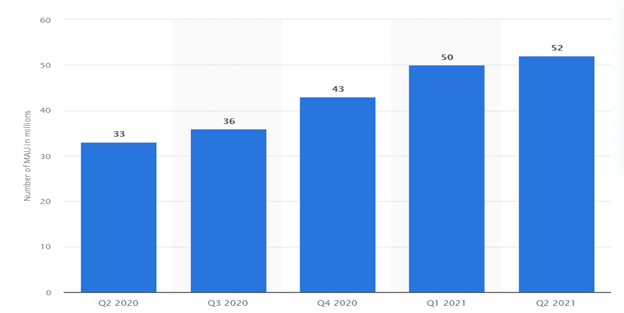

Pluto TV: ViacomCBS acquired Pluto TV at the beginning of 2019 with a revenue base of $70 million in 2018, and by 2021 end will be over $1 billion (Compounded Growth Rate of 142% per year). Pluto TV is the AVOD/FAST (Free Advertising-supported streaming television) platform offered by ViacomCBS. The content consumed is mostly live television. Pluto TV has reached more than 52 million global monthly active users (MAUs) across 25 countries, its revenue grew 169% - more than doubling for the 4th quarter in a row. Pluto TV is an attractive platform for those on a budget, as they are not out of pocket consuming content. Coupled with EYEQ (Digital Advertising Platform), I expect Pluto TV to become a revenue-generating giant as it is offered to even more users globally.

Source: • North America: most popular AVOD services 2021 | Statista

Source: • Monthly active users of Pluto TV globally 2021 | Statista

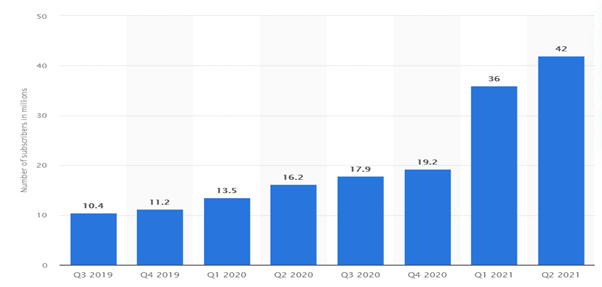

Paramount Plus: is the subscription video-on-demand (SVOD) including the live streaming service of sports (NFL, Serie-A etc.) and local CBS stations. Revenue is generated through subscription fees and advertisements (An advantage of the EyeQ platform). Paramount Plus has two tiers of subscription: a) Premium (No Ads) at $9.99 a month, and b) Essential - $4.99 + Limited Ads per month. The essential option is an attractive option to customers who have subscribed to various other streaming services and is a value proposition for subscribers. By offering these two options to subscribers, Paramount Plus makes its offering relatively sticky when compared to other streaming services. On September 21st, 2021, Paramount Plus announced that it is launching a new streaming bundle that includes Showtime for both its Ad-supported and premium tiers. This offering is at a steep discount compared to if you individually subscribe to Paramount Plus and Showtime separately. This is a great value for subscribers and will enable subscriptions to be stickier in the future.

Source: • CBS All Access and ViacomCBS subscriber numbers in the U.S. 2021 | Statista

Source: • Most popular U.S. multi-platform web properties 2021 | Statista

Streaming revenues for the second quarter increased 92% YoY from $513 million to $983 million.

With streaming services expanding globally, Paramount Plus has launched in Australia and New Zealand in August 2021. ViacomCBS has announced a new deal with Sky to launch Paramount Plus in the UK, Ireland, Italy, Germany and Switzerland to be offered to Sky Cinema tier subscribers who could then pay for the Paramount Plus - Showtime bundle on top of their existing subscription, and also SkyShowtime to be available to consumers in Albania, Andorra, Bosnia and Herzegovina, Bulgaria, Croatia, Czech Republic, Denmark, Finland, Hungary, Kosovo, Montenegro, Netherlands, North Macedonia, Norway, Poland, Portugal, Romania, Serbia, Slovakia, Slovenia, Spain, and Sweden.

The above-mentioned two services are expected to launch in 2022 and I expect a considerable boost in revenues from the European subscribers.

With the heterogeneous tastes of subscribers, Paramount Plus is well-placed to cater to viewers by offering sports, news, unscripted content, and content for kids (Nickelodeon) under the Paramount Plus brand. For the second quarter of 2021, streaming services accounted for 15% of revenues. By the end of 2022, I expect streaming revenues to contribute to a larger percentage of the revenue pie.

With the increase in penetration of better and cheaper connected TVs, I expect households to shift from cable TV set-top boxes to broadband-connected streaming services in the future.

4) Theatrical: Due to the pandemic and the following lockdown, the production of movies had stalled, which delayed the release of movies and affected theatrical revenues. I expect revenues to return to pre-pandemic levels once vaccination rates have gone up and audiences feel more comfortable returning to theatres en masse. I expect increased theatrical revenues in 2022 due to the tentative big-ticket releases of Mission: Impossible 7 and Top Gun: Maverick, which will be distributed by Paramount Pictures.

5) Licensing and other: With continued global streaming expansion by ViacomCBS, ViacomCBS will reduce the amount of original content they make and license to third-party streamers. I believe this decline in licensing revenues will be more than offset by an increase in the streaming segment revenues due to the increased value of content for existing and potential subscribers. Licensing and other revenues fell 36% YoY for the 2nd Q from $ 1,944 million to $1,243 million.

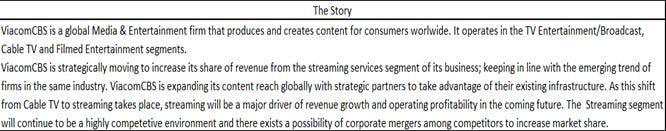

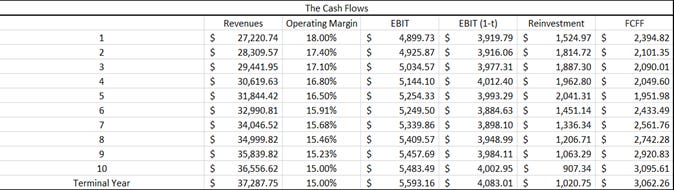

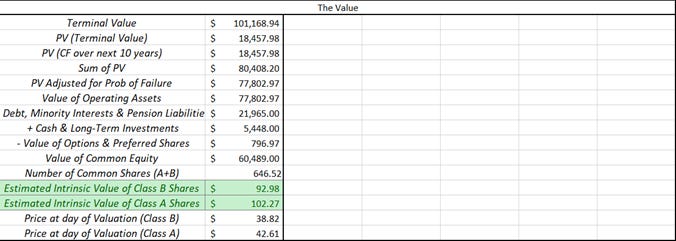

DCF Valuation Model Summary

Assumptions of Inputs

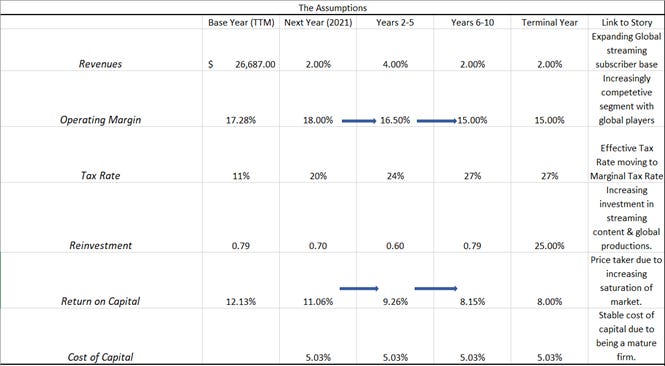

1) Revenues: As ViacomCBS expands its streaming services worldwide (25 countries in Europe in 2022), I expect global streaming subscriptions to be a major driver of top-line growth in the future. Advertising revenues shall continue to increase with increasing subscriptions of Pluto TV backed by the EyeQ for advertisers. ViacomCBS will concentrate its assets to generate revenues from the streaming services.

2) Operating Margin: ViacomCBS has entered the streaming wars late and will have to compete with other streaming services for Intellectual Properties rights (IPs) (incl. sports rights) to produce big-ticket shows to compete with other streaming services if it wants to attract subscribers globally to grow its revenue base. Example :– Paramount+ will be releasing Halo (based on the video game series of the same name) which is co-produced by Amblin Entertainment (Steven Spielberg). Streaming content expenses will grow as the geographic subscriber base widens (global production). Global expansion with partners (Comcast-Sky in Europe, Reliance in India etc.) will lead to lower margins when compared to those where services are provided independently.

3) Tax Rate: I have extrapolated taxes paid in the past for the short and medium-term forecasts and, over the long-term, I expect taxes paid to reflect the corporate marginal tax rates.

4) Reinvestment: Reinvestment is based on the Sales/Capital ratio which shows the expected amount of reinvestment required for a given increase in revenues. Reinvestment will be higher than before as streaming content expenditures and other expenses relating to expanding global productions increase to attract global audiences increase.

5) Return on Capital: With cheaper capital available and more readily so, and streaming being a relatively new sector, there are fewer boundaries to entrants which will drive up competition and will lead to lower returns of capital over time as the sector matures and consolidates.

6) Cost of Capital: ViacomCBS is expecting the $2 billion sale of Simon & Schuster to go through by the end of 2021 and is selling its non-core assets which will strengthen the balance sheet. I do not think that as ViacomCBS expands – it will take on more debt, rather, the expansion will be funded by cash and Free Cash Flow to the Firm generated by the company, thereby ensuring that debt as a percentage of equity remains relatively stable.

Conclusion of Valuation

“Time is a river. What most fail to grasp is that the river is circular. One man’s death opens the doorway to the birth of the next” (Al-Rahim). Earlier this March, as ViacomCBS issued fresh Class ‘B’ and mandatory convertible preferred shares totalling $3 billion at over a 10-year high stock price, there was not enough appetite for the stock from existing and prospective shareholders, which then led the stock to drop by 10%. As the stock dropped, Archegos Capital Management led by Bill Hwang, who had by then accumulated a large holding position in ViacomCBS through gargantuan amounts of leverage, was faced with a margin call from his prime brokers which he could not fulfil.

By March 26, 2021, Goldman Sachs and Morgan Stanley seized Archegos' position and began dumping their large shareholdings on the market. This fire sale led to a precipitous decline in ViacomCBS stock, which dropped by more than 27% for the day and 50% for the week.

On the day of the margin call, the last nail on the cross of Bill Hwang had been struck. The calamity that transpired on March 2021 was a fat-tailed event, which I believe made the ViacomCBS stock a value and growth proposition. With its estimated intrinsic value to be $102.27 (Class ‘A’) and $92.98 (Class ‘B’) and price at $39.90 (Class ‘B’) & $42.49 (Class ‘A’) with an annual dividend yield of 2.37% (based on current prices), the stock is trading at an attractive value, with a business behind it that has potential to grow.

I believe that ViacomCBS's expansion into new markets in 2022 and beyond will lead to growth in revenues, profits, and cash flows, which will lead to the market coming out of the shellshock of March 2021 and will value the shares appropriately. Of this, I am not uncertain.

Disclosure – I have opened a position in ViacomCBS after writing this equity research report.