Paramount Global (Nasdaq: PARA) - Resurrection of Share Price?

Paramount Global - Changing with the times.

For a brief overview of Paramount Global's business, please refer to my previous write-up below.

“Heroin is still heroin whether you snort it or shoot it.” - Jon Stewart on The Daily Show

The above quote encapsulates the similarities between broadcast, cable TV, streaming, and other mass-consumption entertainment delivery systems. Regardless of the delivery mechanism of mass media, there will always be a demand for premium content produced or acquired by Paramount Global. The enormous scale of the entertainment industry ensures that no single company can dominate completely—no firm can produce all content everywhere and at every stage.

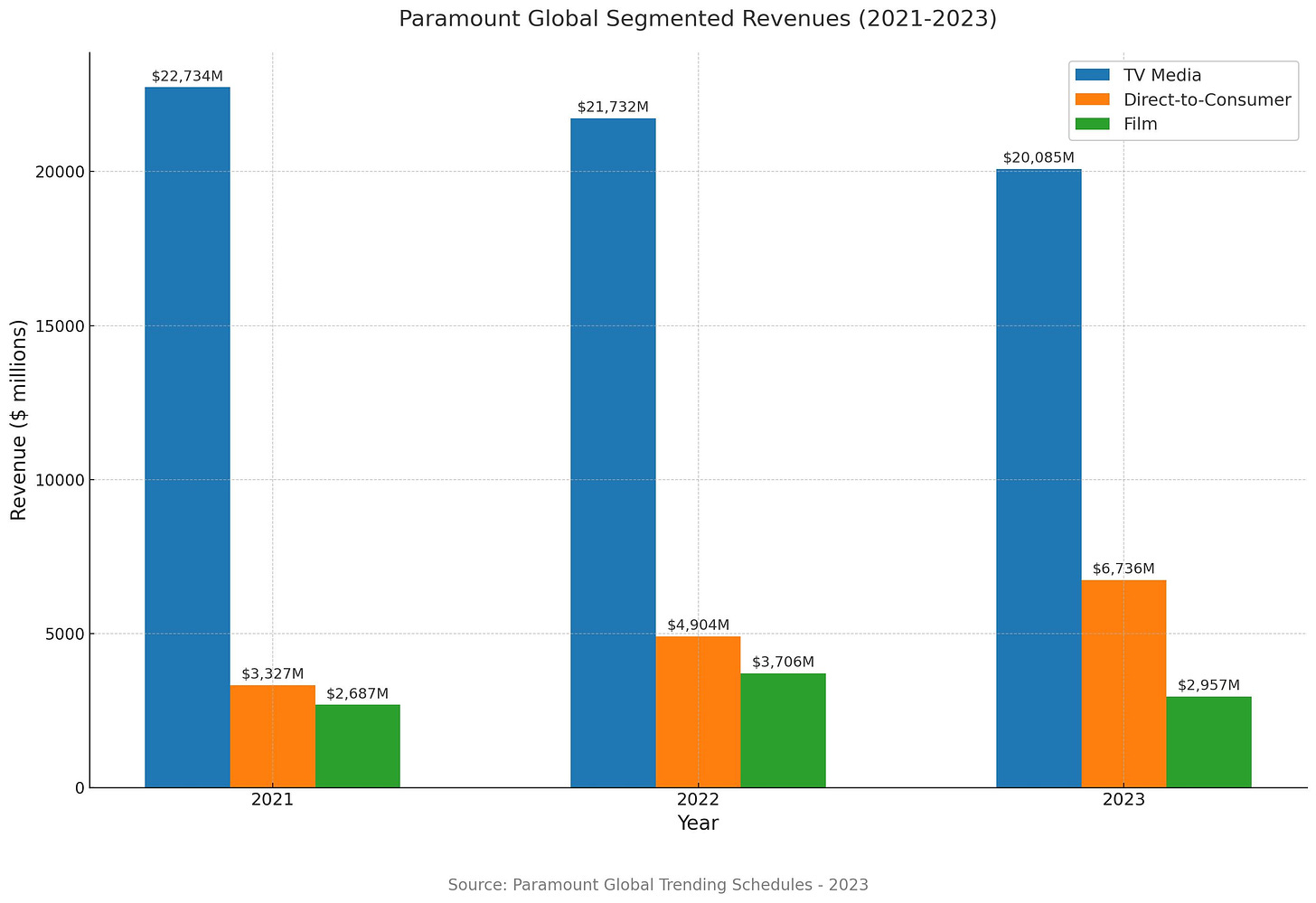

Paramount Global consists of 3 business segments:

TV Media - Include broadcast operations like CBS Television Network, CBS Owned Stations, and domestic & premium cable networks like MTV, Comedy Central, CBS Sports.

Direct-to-Consumer - Paramount+, Pluto TV, and BET+.

Filmed Entertainment - Paramount Pictures, Paramount Players, Paramount Animation, Nickelodeon Studio, Awesomeness, & Miramax.

The broadcast service transmits CBS, among other channels, to viewers, generating advertising revenue for Paramount Global. Viewers can choose between cable TV, broadcast, and satellite TV delivery systems to watch CBS and other basic and premium channels mentioned above. Most of the TV Media segment revenue comes from affiliate fees and advertising sales. Additionally, viewers can access SVOD and AVOD services like Paramount+ and Pluto TV either directly or through vMVPDs such as YouTube TV and Fubo TV, or via other services like SkyShowtime in Europe and the Nordics.

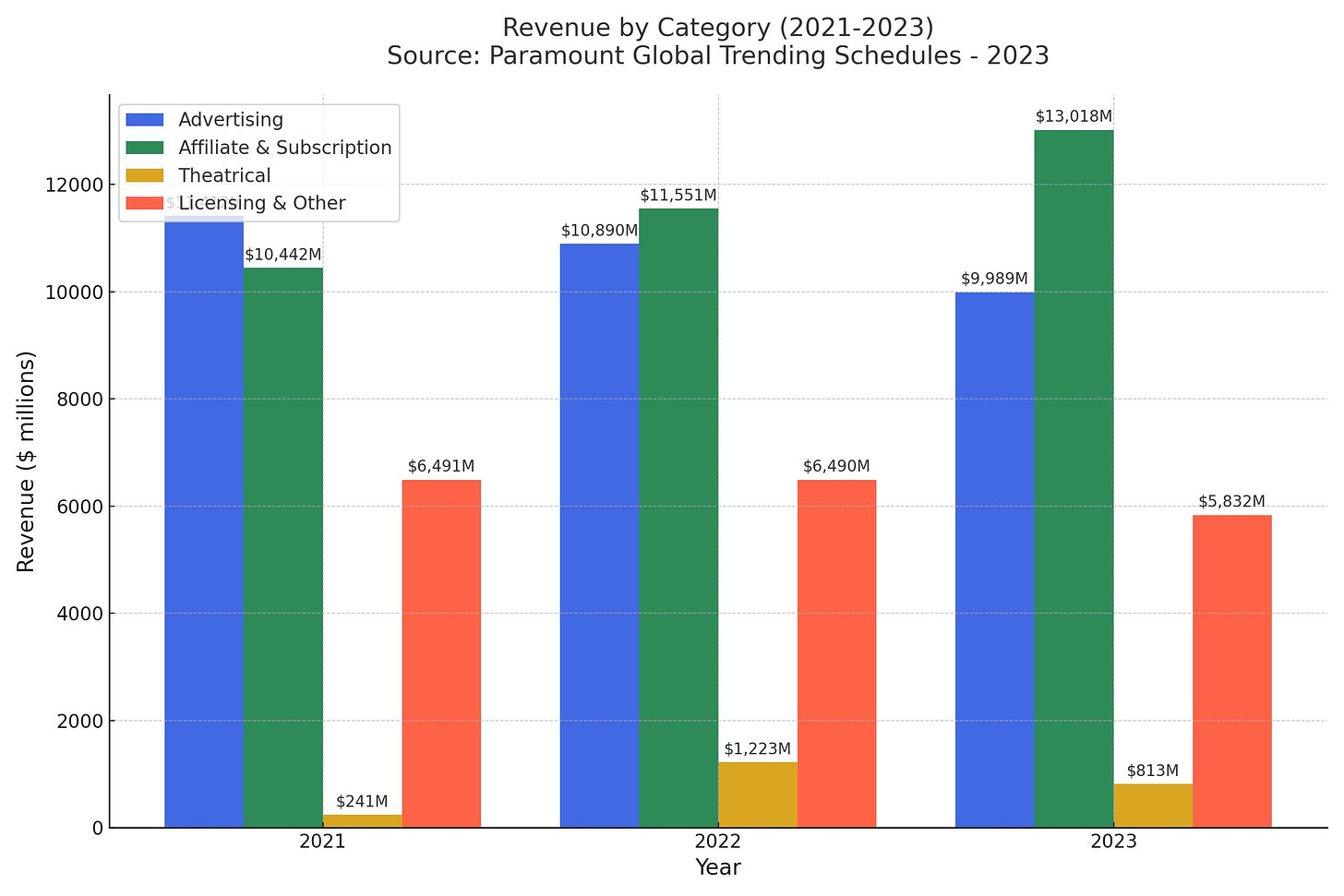

The main sources of revenue for Paramount Global are:

Advertising - Advertising spots are sold to buyers during programs and include AVOD from Pluto TV, as well as ad revenue from cable, satellite TV, and Paramount+. Viewership statistics play a significant role in determining the advertising rates of programs. Premium events, such as the NFL Super Bowl and boxing matches, command top-dollar advertising fees.

Affiliate and Subscription - Fees are received from MVPDs and vMVPDs for distributing cable and satellite TV, based on subscriber numbers. Similar to advertising revenue, the quality and quantity of content are key factors in determining the fees earned from affiliates and subscribers. Subscription fees are also generated through services like Paramount+ and BET+.

Theatrical Revenues - Revenues from theatrical ticket sales.

Licensing & other Revenues - Fees earned from licensing content rights to third-party companies.

Valuation Modelling & Narrative

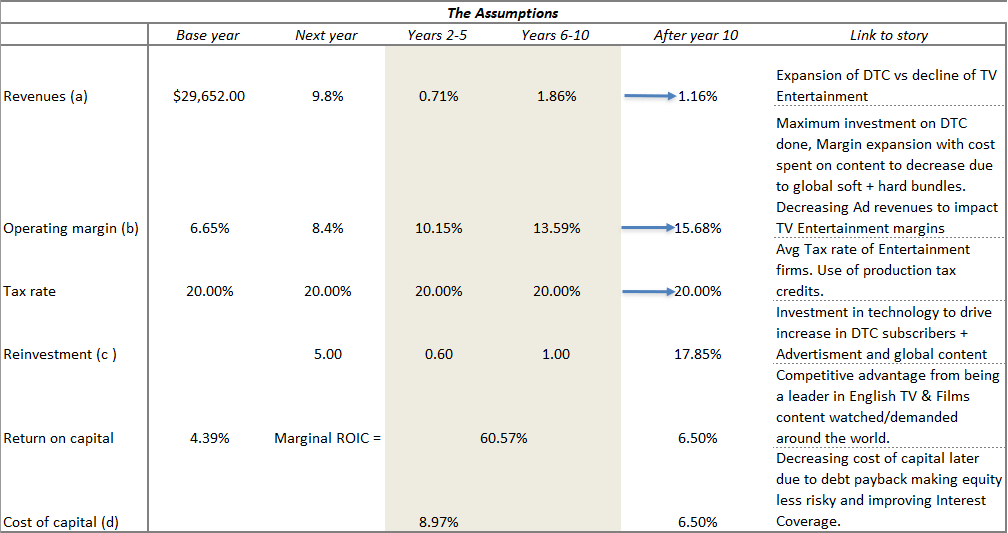

Assumptions of Inputs

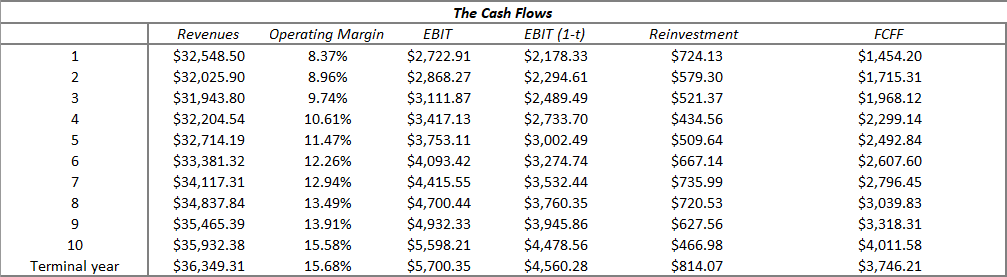

Revenues:

In the coming years, revenues from Affiliate and Subscription services are expected to significantly exceed those from Advertising, leading to a more stable top line than previously observed. This growth is primarily attributed to an increase in ARPU (Average Revenue per User) within the business's DTC (Direct-to-Consumer) segment. Subscription revenue is expected to grow at a much faster rate, whereas affiliate revenue is forecast to grow at a rate comparable to the overall economy, as traditional MVPDs (Multichannel Video Programming Distributors) are either supplanted by vMVPDs (Virtual Multichannel Video Programming Distributors) or adapt their offerings and delivery mechanisms to accommodate streaming. This adaptation aims to retain existing subscribers and attract new ones. Licensing is expected to remain a vital component of the revenue stream, effectively broadening the global audience and guiding them towards the DTC suite's other services. One strategic approach involves licensing a TV show or movie and creating an exclusive spin-off for streaming services like Paramount+ and Pluto TV.

We forecast that by the end of FY 2028, the Direct-to-Consumer (DTC) segment will surpass the TV Media (Cable TV & Broadcast) segment in revenues. For FY 2024, we expect TV Media revenues to grow by 4% due to an exceptional Super Bowl LVIII, March Madness, and significantly increased advertising sales owing to the upcoming US General Election season. The decline in subscribers for the TV Media segment, due to cord-cutting and reduced viewership numbers, will contribute to falling revenues resuming in FY 2025. However, we anticipate an overall increase in firm-wide revenue as cord-cutters transition to DTC services to watch their favourite programs, movies, or sports via streaming in subsequent years.

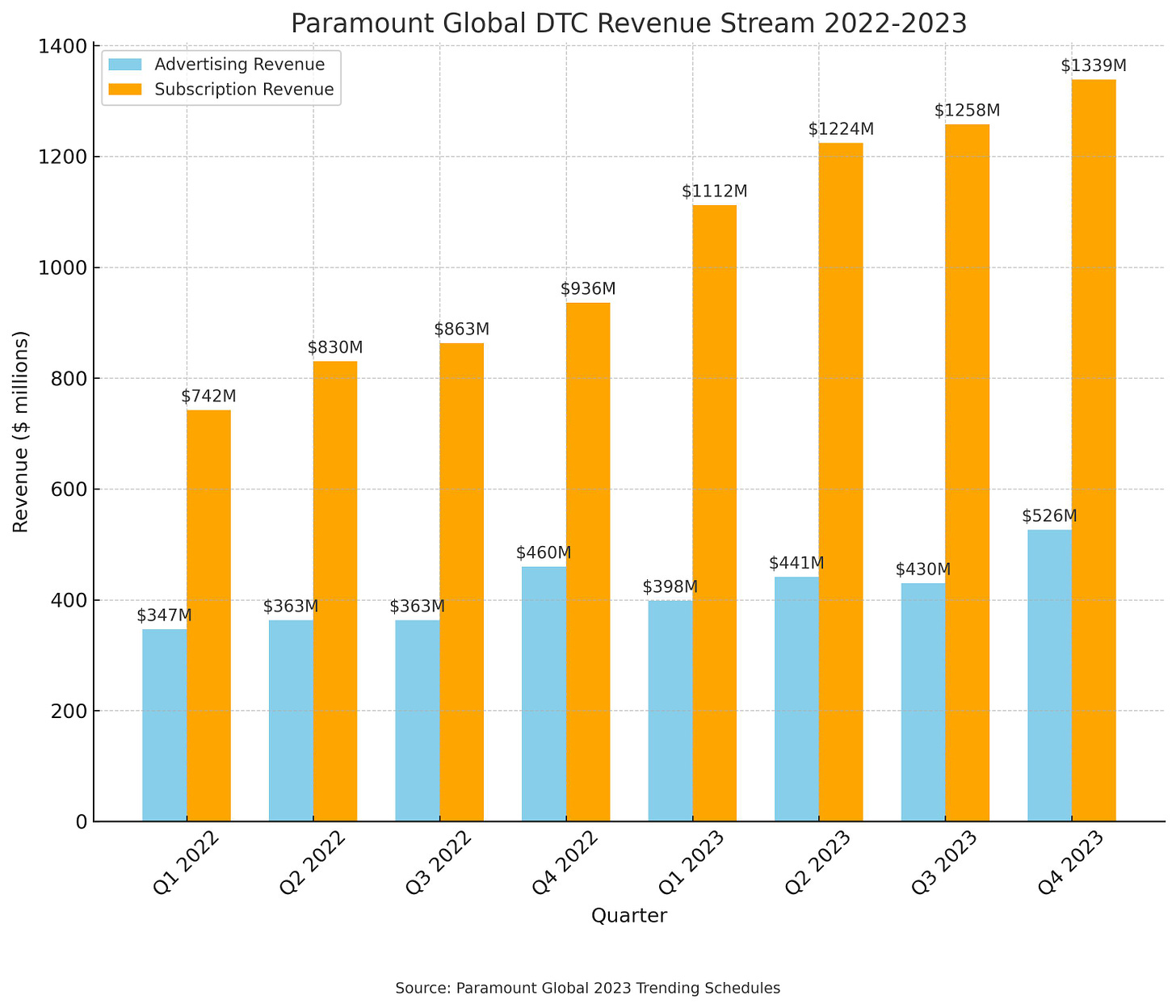

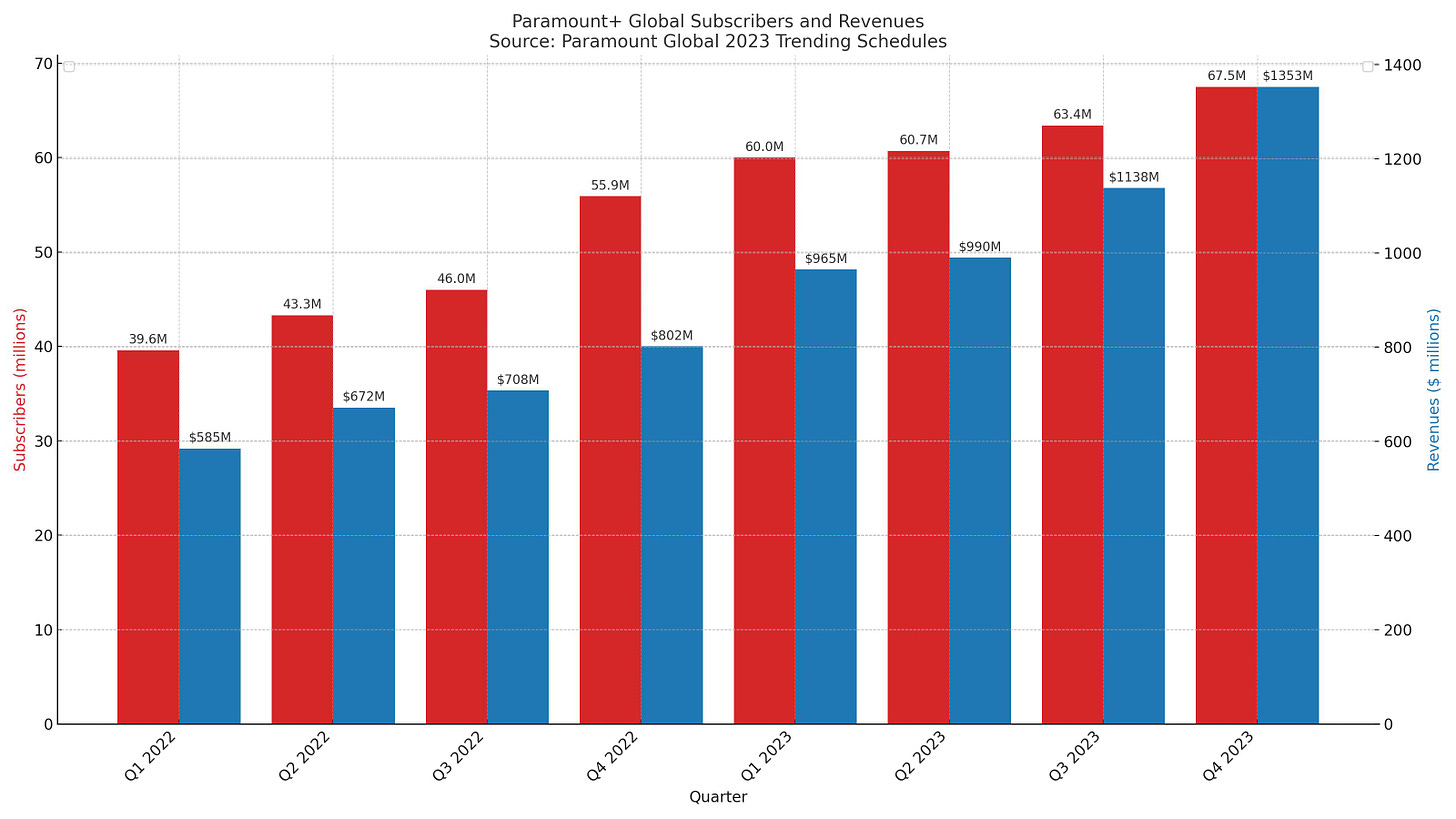

The DTC segment is expected to be less cyclical than traditional Cable TV & Broadcast, owing to a lower percentage of overall advertising revenue. As the business grows and matures, we project an increase in DTC revenues, driven by an increase in Average Revenue Per User (ARPU) as subscription prices rise, the acquisition of more subscribers through international expansion, and a reduction in the number of offered free trials. The DTC segment has seen revenues grow at a CAGR of 42.29% over the past two years and a YoY growth rate of 37.36%.

Paramount+, which essentially began in 2021, has made significant strides in the past quarters despite its short history. The subscriber count has grown at a CAGR of 43.45% over the past two years, and revenues have increased at a CAGR of 81.67% during the same period, with a YoY growth rate of 60.68%. With international expansion and subscription price increases, we expect Paramount+ to have considerable potential for further growth.

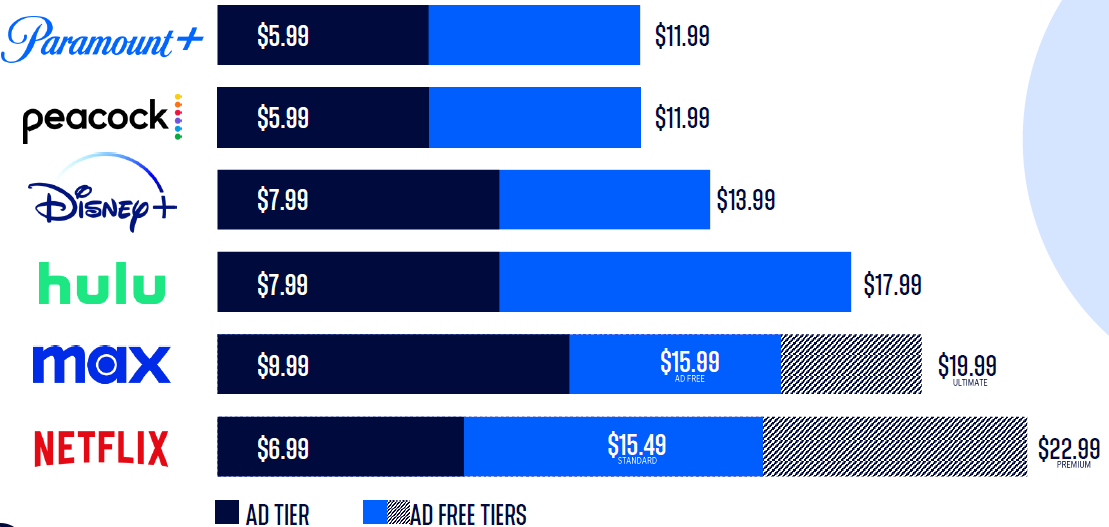

Paramount+ continues offering great value to subscribers and plans to adopt a three-tier subscription service globally. This year, the service will be available in Australia, the UK, France, and Brazil, featuring Basic Ad-tier, Standard tier, and Premium tier options. This strategy will showcase the value proposition to potential subscribers, who can upgrade to the Premium tier for high-quality viewing experiences, including 4K UHD, HDR 10, Dolby Atmos, and Dolby Vision.

Pluto TV, the AVOD service from Paramount Global, is and will continue to be a significant attraction for subscribers in developing countries where viewers may not want to pay for another streaming service in addition to their existing cable, satellite TV, telephone bills, and where penetration of pirated content has been high. The premium content on Pluto TV is competitive enough to attract viewers with the cost of watching a few advertisements per program, further bolstered by the appeal of top-notch Hollywood content worldwide.

We understand the limits to predicting box office success for the Filmed Entertainment segment. From a qualitative standpoint, Paramount has a great film slate going forward as showcased in CinemaCon 2024. We forecast filmed entertainment revenue to grow at historical rates for the Hollywood industry & operating margins to remain at pre-pandemic historical levels. Once a film’s theatrical run has been completed, a great film slate can then drive viewers to Paramount+ and Pluto TV.

Operating Margin:

Paramount Global is actively striving to return to profitability, as evidenced by management's actions such as cost-cutting layoffs, focused production expenses, and reduced spending on experimental foreign content. While these measures will improve the firm's operating margin, it's important to recognize that efficiencies have limits in boosting operating margins & income. Further reductions in content spending could eventually impact the top line due to fewer programming choices for viewers, potentially leading to a significant decrease in operating margins & income for the firm.

Paramount Global recognizes that each country has specialized local content that resonates with its viewers. Tastes in entertainment vary significantly worldwide, creating a competitive landscape in the entertainment, cable TV, and broadcast industry where local firms often hold a competitive advantage over international companies. For example, Disney, despite being a global powerhouse, plays a secondary role in its joint venture with JioCinema in India. In this context, the management's strategy to scale back on hyper-localized content in certain countries while focusing on areas where it has a competitive edge could enable Paramount to reduce its global content expenditure. Bundling Paramount+ with other platforms and services will ensure lower operating and customer acquisition costs than operating independently, which should help enhance the bottom line. Moreover, forming partnerships with local entertainment firms and offering Paramount's content as an add-on is likely to increase revenue while keeping costs low in international markets. Over the past two years, Paramount Global has engaged in various partnerships, including with J:Com—a leading cable TV & broadband operator in Japan, and WOWOW Inc.—the top premium pay channel, as well as a joint venture in several European countries known as SkyShowtime. Partnerships also extend to JioCinema in India and CJ ENM in South Korea, among others.

Tax Rate:

Based on the average effective tax rate of Paramount Global and other similar firms in the entertainment industry.

Reinvestment:

Reinvestment is based on the Sales/Capital ratio, which indicates the expected reinvestment needed for a given increase in revenues. We believe that streaming content expenditure reached its peak in 2022, but due to the strikes last year, there will be an increase in content spend for the next two years compared to the current year. We anticipate future content efficiencies due to acquired knowledge about which content maximizes value and attracts viewers to Paramount Global's platforms. Major reinvestment will focus on enhancing cloud architecture, increasing advertising in global markets where Paramount+ plans to expand, and developing software engineering and technology to improve the User Interface (UI) and functionality of Paramount+ to enhance subscriber experience.

Return on Capital:

We expect the Return on Invested Capital (ROIC) to increase as profitability benefits from partnerships and global content bundling. In the long run, given competition and market saturation from other entertainment companies and industries such as gaming, experiences, and social media platforms like TikTok, we anticipate that the return on capital will equal the long-term cost of capital.

Cost of Capital:

We expect Paramount Global to significantly reduce its debt burden over the long term while maintaining a sufficient cash balance from increased free cash flow in the coming years. This should lower the cost of debt by improving the credit rating and reduce the cost of equity by making the firm less risky. Together, these changes would lead to an overall reduction in the Cost of Capital.

Thoughts on Valuation, Market Pricing, and M&A

There has been and continues to be a considerable difference between market price and value. The current market narrative for Paramount suggests that the DTC segment's losses will persist and the entire TV media segment will be entirely cannibalized by streaming, with only Netflix emerging as the winner of the "Streaming Wars"—which is complete horseshit!

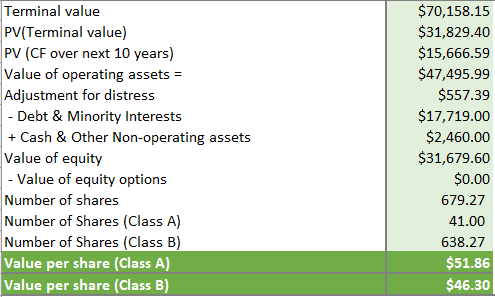

TV Media revenue has certainly decreased by upper single digits, and the operating margin for the segment has declined relatively slowly from 25.9% two years ago to 23.85% at the current fiscal year-end. While this may change as revenue decline accelerates, we expect resources from the TV Media segment to be redeployed to the DTC segment as it becomes the primary distribution method. This should further help to lower operating and content costs and increase margins for Paramount. As Paramount+ and Pluto TV expand their services worldwide, DTC revenues have gone from strength to strength since the segment was given increased importance by management over two years ago; Paramount+’s subscriber base has increased from 32.8 million two years ago to 67.5 million today, ARPU has increased, DTC advertising revenues have increased too, while content spending has peaked, operating losses have decreased considerably from -37.1% to -24.7% in a year and are due to be domestically profitable by year-end. This demonstrates that Paramount is a legitimate competitor in the streaming arena, the market is mistaken if it believes Paramount ought to "curl up and die" before competitors like Netflix, Amazon Prime Video, and Disney.

Consider this analogy: Suppose I have a $10 bill, and you have a $100 bill. If I were to claim that my bill is worth $40 and yours is worth $50 and propose combining our funds while extolling the benefits of such a transaction, you might perceive this as outright theft.

The current share price predicament stems from Paramount Global's dual-class equity structure: PARAA (which holds voting rights) and PARA (which does not). Ms. Shari Redstone holds 9.76% of the total shares but controls 77.4% of the voting power. This structure, combined with her majority in voting rights, positions her interests in conflict with other shareholders.

The speculated deal involves Skydance Media purchasing National Amusements, Inc. (Ms. Redstone's firm) for approximately $2 billion, then merging with Paramount Global in a transaction valued at $5 billion. Gaining control of one of the largest entertainment companies in the U.S. for a mere $2 billion could be seen as the deal of the century. For Skydance Media, the transaction is advantageous as it overvalues itself based on previous funding rounds and undervalues Paramount Global based on current market conditions, amidst the looming threat of the controlling shareholder's influence. This act of desperation by Ms. Redstone could cost the other Paramount Global shareholders dearly.

The market seems to have forgotten that negative and lower margins in a new business (DTC segment for Paramount) are a feature and not a bug of the business cycle. Due to initial and ongoing losses (feature, not a bug), we believe equity values are temporarily deflated and so, It would be a grave miscalculation to use Enterprise Value as a proxy for firm value, which is what the Skydance deal seems to be doing—$2 billion approximately for Ms. Redstone’s 10% overall stake in Paramount Global.

The current deal with Skydance Media is unpopular and disproportionately favours Ms Redstone and Skydance shareholders that we expect lawsuits, injunctions, and other legal avenues to be pursued with certainty by other Paramount shareholders. Given these factors, we do not anticipate the deal proceeding in its current form without equitable compensation for minority shareholders. Furthermore, the expected purchase of NAI may proceed, but the merger between Skydance and Paramount likely will not, or a competitive bidding process may commence by May 2024. We should be cautious of grandiose terms like "synergies" and "deleveraging the balance sheet" being touted with this deal—ultimately, such phrases often amount to empty promises. Should the company require expertise in adopting artificial intelligence (AI) or similar technologies, hiring top talent from the broader tech industry, or competitors would be more cost-effective than paying $5 billion for a company. Additionally, Apollo Global Management's $27 billion bid for the entire firm seems to be a low starting offer and shareholders can expect further price discovery during a bidding war.

It is evident from the financial statements and management's history of exceeding goals ahead of schedule that Paramount is on a path to growth and profitability. This is not a distressed company needing to sell itself at a discount or liquidate shareholder value to de-lever its balance sheet with urgency. Paramount has debt maturities totalling $2,643 million over the next five years: $126 million due on 05/15/25, $347 million on 01/15/26, $86 million on 10/04/26, $584 million on 01/15/27, $500 million on 02/15/28, another $500 million on 06/01/28, and $500 million on 06/01/29. With approximately $3,000 million in cash, the company is well-positioned. In March 2021, Paramount issued 20 million Class B shares at $85 per share, receiving net proceeds totalling $1.67 billion. Since 2010, the board of directors has authorized share repurchases totalling $17.9 billion, demonstrating a strategic approach to shareholder value. As of December 2023, there remains $2,300 million authorized for the share repurchase program. As the DTC segment grows larger, moves to profitability and free cash flow grows, management might consider buying back undervalued shares—a potential catalyst for a price increase and a strategic move to create shareholder wealth. We anticipate the market will revise its perspective on Paramount, projecting the stock price to significantly exceed its intrinsic value of $41.823 - $51.117 by December 2025. We expect a partial validation of our thesis on the price convergence to intrinsic value by the end of this year, assuming Paramount is not sold. In the end, with respect to the M&A speculation - Que Sera, Sera!